is a new roof tax deductible in 2020

If you decide to completely replace a buildings new roof you can now take an immediate deduction of up to 1040000 in 2020 for the cost of the new roof. Act fast to lock in the best tax credits.

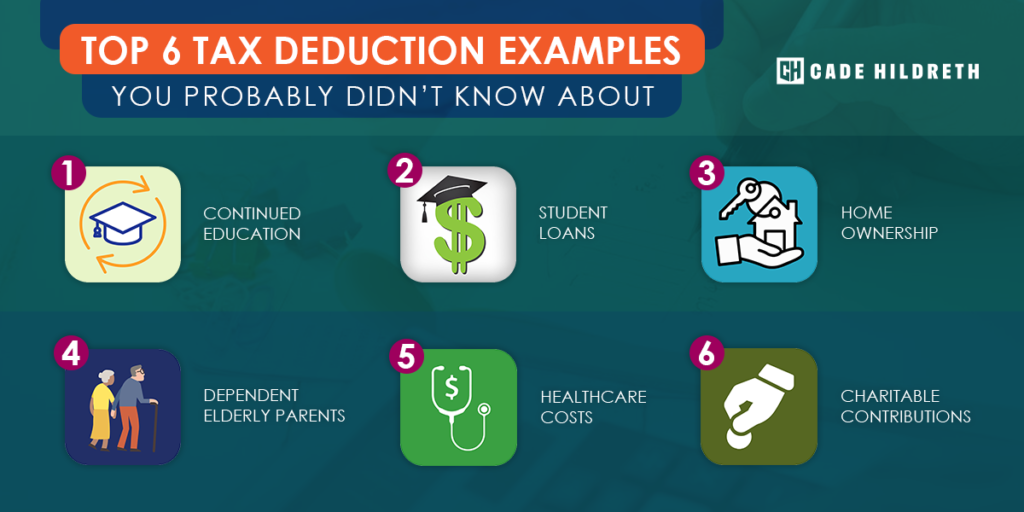

Top 6 Tax Deduction Examples You Probably Didn T Know About

In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

. If you get a new roof the Section 179 deduction allows you to deduct the cost of it. If you decide to completely replace a buildings new roof you can now take an immediate deduction of up. However you cant deduct the entire cost at once.

How much should you pay a roofer upfront. Is a new roof tax deductible in 2020. Certified roof products reflect more of the suns rays which can lower roof surface temperature by up to 100F decreasing the amount of heat transferred into your home.

If you decide to completely replace a buildings new roof you can now take an immediate deduction of up to 1040000 in 2020 for the cost of the new roof. The ENERGY STAR metal roof tax credit was extended from December 31 2017 to December 31 2021. What property repairs are tax deductible.

In 2021 the savings are 26. Taxpayers should claim the deduction on schedule e of their tax return and file form 4562 in the year the new roof is put in service. Is not available for the 2020 tax year as it has been retroactively repealed.

An example is the cost of replacing roof tiles blown off by a. If you get a new roof the Section 179 deduction allows you to deduct the cost of it. If you get a new roof the Section 179 deduction allows you to deduct the cost of it.

Is a new roof tax deductible in 2020. Is a new roof tax deductible in 2020. Is a new roof tax deductible.

Basically any maintenance and repair expense that maintains the value and state of your rental property counts as a deductible. Is a new roof tax deductible in 2020. Installing a new roof is considered a home improvement and home improvement costs are not deductible.

However home improvement costs can increase the basis of your property. Is a new roof tax deductible 2020. On the same subject.

Answer Unfortunately you cannot deduct the cost of a new roof. If you decide to completely replace a buildings new roof you can now take an immediate deduction of up to 1040000 in 2020 for the cost of the new roof. Instead youll need a depreciation schedule which refers to dividing the cost over the useful life of the improvement.

Repair means the restoration of an asset by replacing subsidiary parts of the whole asset. This tax credit is for ENERGY STAR certified metal and asphalt roofs with pigmented coatings or cooling granules designed to reduce heat gain. You might be interested.

Installing a new roof is considered home improvement and home renovation costs are not deductible. We are not accountants so please talk this over with a. Is A New Roof Tax Deductible The amount you pay to purchase a new roof receives investment treatment and cant be taken as a deduction on your tax return.

However installing a new roof on a commercial property or rental property is eligible for a tax deduction. This tax credit is for ENERGY STAR certified metal roofs with pigmented coatings designed to reduce heat gain. Is there a tax credit for a new roof in 2020.

The ENERGY STAR metal roof tax credit was extended from December 31 2017 to December 31 2021. If you get a new roof the Section 179 deduction allows you to deduct the cost of it. Is a new roof tax deductible.

How to write a letter of continued interest for law school. Then youll be able to avail yourself of tax deduction benefits on the current years expense. These expenses include cleaning costs repainting plumbing and electrical repairs broken window replacements and so on.

How much does a 5 gallon bucket roof coat cover. 49000 worth of free energy and homeowners can take advantage of government tax credits of 30 of the install cost-70600. If you decide to completely replace a buildings new roof you can now take an immediate deduction of up to 1040000 in 2020 for the cost of the new roof.

Unfortunately the cost of a new roof cannot be deducted. Other common examples of home improvements are a new roof new driveway a new septic system or brand new appliances. This is great news for homeowners wanting a tax break for making a smart investment in a new roof.

Is a new roof tax deductible in 2020. However home renovation costs can increase the foundation of your property. So they send out a replacement head a week later.

So you can deduct the cost of a new roof from your annual taxes. Installing a new roof is considered a home improvement and home improvement costs are not deductible. For most homeowners the basis for your home is the price you paid for the home or the cost to build your home.

Are Roof Repairs Tax Deductible B M Roofing Colorado

Tax Deductions On Rental Property Income In Canada Young Thrifty

Are Your Insurance Premiums Tax Deductible Merit Insurance Brokers

Moving Tax Deductions In Canada 2022 Turbotax Canada Tips

Are Roof Repairs Tax Deductible The Roof Doctor

Rental Property Tax Deductions

Roof Replacement Tax Credit Leaffilter Gutter Protection Ca

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Top Tax Deductions For Second Home Owners

Is Rent Tax Deductible How To Write It Off If You Re Self Employed

Are Your Commercial Roofing Expenses Tax Deductible

Deducting Cost Of A New Roof H R Block

Can Roof Repairs Be Claimed On Taxes In Canada Canuck Roofing

Are Home Improvements Tax Deductible It Depends On Their Purpose

Tax Deductions For Vacation Homes Depend On How Often You Use It

What Expenses Are Tax Deductible When Selling A House Home Selling Tips Real Estate Education Selling Your House

Can Roof Replacement Be Tax Deductible Here Are The Ways

Good Comparison Of The House Vs Senate Tax Bills Tax Deductions Senate Real Estate